Are you looking for a simple, straightforward guide to opening your own bank account? With just 10 easy steps and some basic information, you can open a new bank account in no time! Whether you're interested in saving money away or want to start splitting bills electronically with friends or family members, having a bank account is an essential part of budgeting and managing your finances. This blog post provides an overview of the process so that you can navigate it easily without any stress or confusion. We'll walk through all the important steps involved in opening a new bank account and provide helpful tips on what specific documents are needed along the way. So, let's get started!

How to Open a Bank Account in Just 10 Steps ?

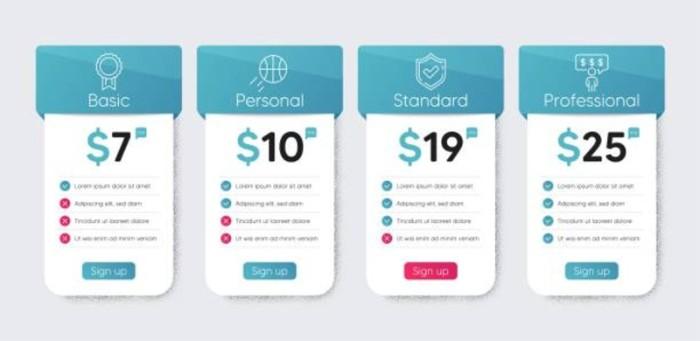

1. Select a Bank: First and foremost, you'll want to choose the bank that's right for you. Consider factors such as the types of accounts available, fees associated with different accounts, and any special services or programs offered by certain banks.

2. Gather Required Documents: You will need to bring some documents along to open your new account; these may vary depending on the type of account you choose. Generally, banks will require a valid form of government-issued identification (e.g., driver's license or passport), Social Security number, and proof of address (e.g., utility bill or lease agreement).

3. Choose Account Type: You will need to decide what type of account you'd like to open. Most banks offer checking, savings, and money market accounts. Each type of account has different features and benefits associated with it that you should take into consideration when making your decision.

4. Set Up an Initial Deposit: Most accounts will require some initial deposit to get started; this could be cash, a check, or even a direct transfer from an existing bank.

5. Fill Out an Application: Once you've gathered all of the necessary documents and determined which type of account you'd like to open, you'll need to complete a bank application form. This includes providing personal information such as name, address, date of birth, etc., in addition to your Social Security number and other pertinent information.

6. Agree to the Terms & Conditions: Before you can open your new account, be sure to read and understand the terms and conditions associated with it. This includes any applicable fees, minimum balance requirements, deposit limits, etc.

7. Submit Your Application: Once you've completed your application form and agreed to the terms & conditions of your new bank account, it's time to submit your application. You may have the option of submitting online or in-person at a local branch.

8. Set Up Online Access: Many banks offer convenient online banking services, so you'll want to set up access as soon as possible. This will allow you to manage your account and view account activity from anywhere with an internet connection.

9. Receive Your Debit Card: After your application has been reviewed and accepted, you will receive a debit card associated with the account. Be sure to keep track of it and protect it as you would any other form of payment.

10. Start Using Your Account: Congratulations! You're now ready to start using your new bank account. Whether it's for saving or spending, make sure to monitor your balance regularly so that you stay on top of it.

Now that you know the steps involved in opening a bank account, you can begin your journey toward financial freedom with confidence! Good luck and happy banking!

Gather Necessary Documents and Information :

Be sure to have all the necessary documents and information ready before you start the process. This could include a valid form of government-issued identification, Social Security number, proof of address, initial deposit amount, etc.

Read & Understand Terms & Conditions: Before submitting your application, take some time to read and understand the terms and conditions associated with the account type that you’re interested in. Make sure to pay special attention to fees, minimum balance requirements, and any other pertinent information.

Submit Application: Once you’ve gathered all of the necessary documents and have read & agreed to the terms & conditions associated with your account type, submit your application either online or in-person at a local branch.

Set Up Online Access: Many banks offer convenient online banking services, so you’ll want to set up access as soon as possible. This will allow you to manage your account and view account activity from anywhere with an internet connection.

Receive Debit Card & Begin Using Your Account: After your application has been reviewed and accepted, you will receive a debit card associated with the account. Be sure to keep track of it and protect it as you would any other form of payment. Then, you can start using your new bank account for saving or spending!

Opening a bank account doesn't have to be complicated or stressful. By following these 10 simple steps, you'll be well on your way to financial freedom in no time! Good luck and happy banking!

Conclusion:

Opening a bank account is an essential part of budgeting and managing finances. With just 10 easy steps and some basic information, you can open a new bank account in no time! Make sure to select the right bank for you, gather all necessary documents and information, read & understand terms & conditions, submit your application, set up online access, receive your debit card, and begin using your account. With these steps in mind, you'll have no trouble navigating the process and starting your journey toward financial freedom. Good luck and happy banking!

FAQs:

Q: What documents do I need to open a bank account?

A: Generally, banks will require a valid form of government-issued identification (e.g., driver's license or passport), Social Security number, and proof of address (e.g., utility bill or lease agreement).

Q: How do I choose the right bank for me?

A: Consider factors such as fees, services offered (e.g., online banking, overdraft protection, etc.), minimum balance requirements, and any other pertinent information.