Are you looking to improve your investing strategy while bringing in additional income? Selling cash-secured puts is a great way to do that. Cash-secured put writing, also known as covered option writing, is becoming an increasingly popular investment strategy for traders who want the potential of high returns with little risk.

We'll explain cash-secured puts and how you can use them effectively to obtain passive income and enhance your portfolio.

Selling Cash-Secured Puts

Cash-secured puts are a form of investing that involves selling options on an underlying stock you do not own to profit from the option premium. When writing cash-secured puts, the investor must buy shares at the strike price if the option is exercised by someone else.

To protect themselves against potential losses, investors must have enough cash to cover any exercise costs.

That’s why it’s called ‘cash-secured’ instead of just ‘put selling.’ Since cash-secured puts don't require margin or loan collateral, they are considered low-risk investments. This makes them attractive for investors who want to increase their portfolio's potential return without a large risk of loss.

Benefits of Selling Cash-Secured Puts

1Low Risk Investment Strategy

One of the primary benefits of selling cash-secured puts is that it’s a low-risk investment strategy. Since you have enough cash to cover any exercise costs, there’s no need for margin or loan collateral. This makes them attractive for investors who want to increase their portfolio's potential return without a large risk of loss.

Potentially Generate Passive Income

When writing cash-secured puts, investors can generate passive income from the option premiums they receive when they write and sell the options contracts. The key is to find stocks with higher option premium prices than their intrinsic value to maximize profits while minimizing risks.

Enhance Portfolio Performance

Cash-secured puts can be used to enhance portfolio performance. By writing and selling high-quality put options, investors can reduce their portfolios' volatility while potentially generating additional income. This allows them to benefit from any fluctuations in the market without having to make a direct investment.

Use Leverage To Increase Returns

Investors can use leverage to increase their potential returns when writing cash-secured puts. Since they don’t need margin or loan collateral, they can leverage their cash reserves; this gives them an added return boost compared to buying stocks outright.

Diversify Investment Portfolio

One of the best ways for investors to diversify their portfolios is to write cash-secured puts. By writing put options on multiple stocks, investors can spread out their risk and benefit from the performance of several different companies without having to buy each one outright.

Manage Risk

Selling cash-secured puts allows investors to better manage their risk. Since they can set aside enough cash reserves to cover exercise costs, they don’t have to worry about taking on too much risk to generate higher returns.

Take Advantage Of Volatility

When the market is volatile, it could benefit investors looking to profit from selling cash-secured puts. They can take advantage of the fluctuations in the market by writing put options on stocks with higher option premium prices than their intrinsic value.

Time Your Entries And Exits With Ease

Selling cash-secured puts makes it easier for investors to time their entries and exits in the market. Since they don’t need margin or loan collateral, they can quickly and easily enter and exit positions without worrying about financial repercussions.

Selling cash-secured puts can be a great way to generate passive income while enhancing your portfolio performance with minimal risk. By understanding the basics of this strategy, you can take advantage of volatile markets and potentially make money from selling these types of options contracts whether you’re a beginner investor.

Rules to Follow When Selling Cash-Secured Puts

Identify Quality Stocks

Before writing cash-secured puts, investors should identify quality stocks and analyze their prospects for growth. This will help you determine which stocks have higher option premium prices than their intrinsic value to maximize profits while minimizing risks.

Set An Exit Strategy

It’s important to set an exit strategy before entering into a trade. Investors should decide how much profit they want from the premiums and when they plan to exit the position to ensure they manage their risk effectively.

Manage Your Risk

When investing in any market, managing your risk properly by setting stop-losses and never putting less money into a trade than you can afford to lose is important. Selling cash-secured puts offers investors additional protection since they don’t need margin or loan collateral; however, managing your risk is still important.

Diversify Your Portfolio

Diversifying your portfolio by investing in different sectors or industries is essential so you are not overexposed to any particular sector or asset class. You can write put options on multiple stocks; this will help spread out your risk and potentially benefit from the performance of several different companies without having to buy each one outright.

Monitor Your Positions

Once you have opened your position, it’s important to monitor the performance of your trade and adjust accordingly. This will help you determine when to exit the position to maximize profits and minimize losses.

By following these rules, investors can profit from selling cash-secured puts for income. By understanding the basics of this strategy, you can take advantage of volatile markets and potentially make money from selling these types of options contracts. Whether you’re a beginner investor or an experienced trader, this investment strategy can help you bring in additional passive income while enhancing your portfolio performance with minimal risk.

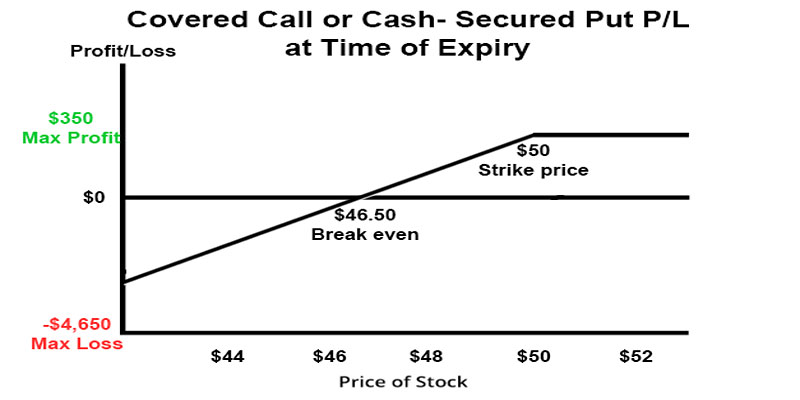

How to Calculate the Maximum Profit and Maximum Loss When Selling Cash-Secured Puts

When selling cash-secured puts, investors need to calculate their maximum profit and maximum loss to determine whether it is a profitable trade. To do this, they must consider the strike price of the option they are writing and the current market value of the underlying asset. The maximum profit from selling cash-secured puts can be calculated by subtracting the premium you receive for writing the put option from 100% (100% represents your maximum potential gain).

For example, if you receive $2 for writing a put on a stock trading at $50 with a strike price of $45, your maximum profit would be $3 ($50 - $47 = 3). The maximum loss when selling cash-secured puts can be calculated by subtracting the premium you receive from the option's strike price. For this example, your maximum loss would be $2 ($45 - $43 = 2). By knowing these figures, investors can make more informed decisions on whether or not selling cash-secured puts is a profitable trade for them.

FAQS

Can you make money selling cash-secured puts?

Yes, you can make money selling cash-secured puts. However, it is important to research before entering any trade and consider the potential risks. By setting an exit strategy and carefully monitoring their positions, investors can maximize their profits while minimizing losses.

Are cash-secured puts a good strategy?

Cash-secured puts can be a great strategy for investors to increase their income while minimizing risk. This investment strategy can help you exploit volatile markets and potentially profit from selling these options contracts. However, it is important to research before entering any trades and consider the potential risks associated with this strategy.

How is selling cash-secured puts right for me?

The decision to sell cash-secured puts depends on your situation and risk tolerance. Before entering into any trades, it is important to consider the potential risks associated with this strategy and understand the maximum profit and maximum loss you could potentially experience. It is also important to set an exit strategy and monitor your positions carefully to maximize profits while minimizing losses.

Conclusion

Selling Cash-Secured Puts For Income is a great way to make some extra income while controlling the risk that comes along with any investment. While Cash-Secured Puts can be quite profitable, they require substantial knowledge to maximize profits and minimize losses. Fortunately, various resources are available to help anyone interested in getting started. It is important to thoroughly understand the strategies involved and practice with a simulated account before investing actual capital.