Utilities are fundamental to the progress of society and the economy. Effective poverty reduction requires reliable public utilities. Ultimately, governments are responsible for ensuring all residents access essential services under openly supervised settings.

There has been a growth in competition in the utility industry, necessitating new approaches to regulation and ownership structures and new types of businesses. As a result, these factors have altered the industry's job stability and quality of life.

To keep their businesses running efficiently and safely, companies must provide their workers with the latest technology and the skills to use it. Human resource planning is complicated since the average age of workers is rising in many nations, and some occupations have a significant gender imbalance.

Jobs in the business should be more accessible and enticing to young men and women to help with the problem of replacing an aging workforce. In addition, investing in employees through apprenticeships and lifelong learning mechanisms, as well as developing national or sector-specific training programs, can be crucial in responding to the industry's evolving skill requirements.

What Is The Utilities Sector?

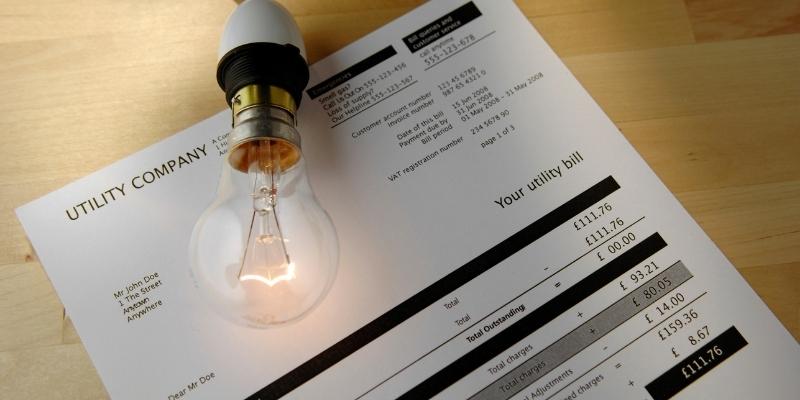

You constantly rely on water and electricity to take a shower and keep the lights on. The utility sector is crucial to these processes because it provides essential services such as water distribution, energy generation, waste management, and more.

Utilities play a vital role in the economy because they provide the necessary infrastructure to ensure that people always have access to necessities like electricity, natural gas, water, and sewers. It's something many of us regularly overlook or disregard as irrelevant. Distributors of utilities such as water, gas, and electricity to customers through extensive networks are included in this industry.

Despite common misconceptions, the telecommunications and broadband internet service industries are not part of the utilities industry. The Utility industry is worth $849 billion, employs over 960,000 people, and comprises 99,699 separate businesses in the United States.

The top three corporations in this industry are in the energy industry, but that's not all it encompasses. Energy providers can use nuclear power, natural gas, solar power, coal power, wind power, and even hydropower to give clients the electricity they need to heat their homes and turn on the lights. In contrast, the only service they offer is power.

How Is The Utilities Sector Supervised?

Utilities supply the public with basic amenities like water, power, and gas. It is why many public and private organizations work together to provide utilities. Government agencies govern utilities to provide equitable pricing for customers.

The utility industry is regulated as follows: One utility firm provides the services and transmission utilities that multiple companies create, eliminating the need for consumers to shop around for the best price. The Federal Energy Regulatory Commission oversees the nation's electricity and natural gas markets.

FERC enforces utility industry laws and regulations and gives the go-light to any industry-related initiatives, mergers, or partnerships. The commission monitors cross-state transmissions of electricity and natural gas and conducts related investigations as needed. The Environmental Protection Agency is just one of many government organizations responsible for regulating water providers.

Deregulation has become a hot topic of debate in the industry. Some businesses and politicians have pushed for less industry oversight for years. Deregulation advocates argue that customers would be better served if prices were set according to market forces like supply and demand.

Implications for Individual Investors

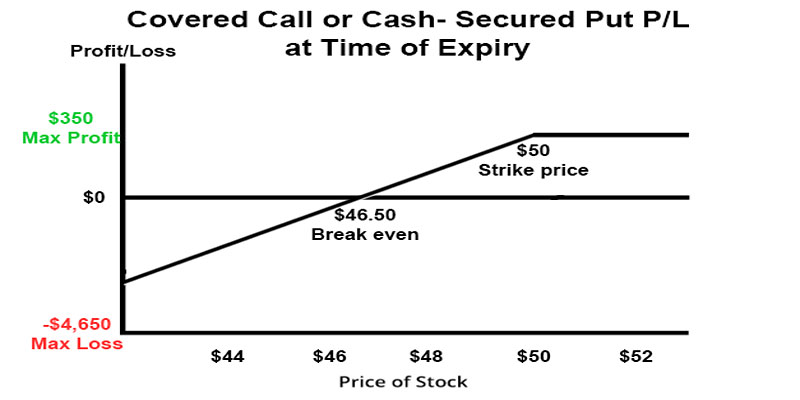

Because utilities are an integral component of contemporary living, the industry that provides utilities is seeing significant growth. As a consequence of this, equities in the utility industry tend to be reliable investments. In addition, the regulation of this business and the lack of competition in most locations make the performance of many utility firms more predictable.

It's a great help in any financial endeavor, especially investment. You can start investing in firms that are part of the utility sector by purchasing exchange-traded funds, often known as ETFs, the S&P 500 Utilities index fund, or by researching individual utility companies and purchasing shares in those companies.

Benefits And Drawbacks Of Utilities

Utilities are reliable assets that often offer a consistent income to shareholders. Because of this, buying and holding utilities for the long term is a popular choice. The dividend yields offered by utility stocks typically exceed those offered by other types of equities.

When the economy slumps and interest rates are low, utilities become more appealing investments. They are characterized by lower levels of volatility and offer an appealing source of investment returns that are more reliably foreseeable thanks to the dividends they distribute on their shares.

On the other hand, utilities are subject to a great deal of regulatory monitoring and call for an expensive infrastructure that must be regularly updated and maintained. To satisfy these requirements for infrastructure, utility companies frequently issue debt instruments, which, in turn, causes their overall debt loads to rise.

Because they rely on debt, these services are also uniquely vulnerable to the possibility of fluctuating interest rates. If rates go up, the corporation will need to increase its yields to entice bond investors. The necessity to adhere to international conventions guaranteeing freedom of association and collective bargaining is a major concern in the Utility industry, along with preventing service interruptions.

Conclusion:

These considerations suggest that utility stocks could be the next hot area for investors to focus on. If you're looking for a promising market, utilities may be the way to go because of their high dividend yields, stability, and reasonable prices. After the markets have recovered from a crash and are on a bull run with occasional corrections, they may be depended upon.

The utility industry has also received significant government attention, and businesses in this field may benefit from recent regulatory measures. Utilities are a sector to watch, especially in this low-interest-rate environment.